WHAT IS TA ON MACRO-FRAMEWORK DEVELOPMENT?

Many ministries of finance and central banks use some versions of IMF financial programming (FP) derived from an interconnected set of macroeconomic accounts: national income and product accounts, balance of payments, government finance statistics, and monetary accounts. FP has proven to be valuable both to IMF staff and member countries for important reasons. Most notably it: (i) supports a detailed bottom-up approach, which is useful for fiscal/budget discussions; (ii) embeds policy analysis in the forecasting process, which is a practical basis for policy-making; (iii) emphasizes accounting consistency, which allows full scope for the application of judgment.

At the same time, these frameworks have limitations. The interaction between quantities and prices is generally ad-hoc. The lack of explicit economic structure combined with excessively rich details could render such frameworks opaque and limit their use for forecasting and scenario analysis. For these reasons, many central banks have already made good progress with putting in place Forecasting Policy Analysis Systems (FPAS) anchored in small semi-structural economic models.

Well-developed, flexible and easily adaptable macroeconomic frameworks have become even more important during and after the COVID-19 pandemic, which has raised questions about both the near-term policy stance and longer-term debt dynamics. The large and evolving range of shocks calls for quick and coherent assessments of the evolving situation and the potential impact of alternate economic policies.

The purpose of the IMF Institute for Capacity Development (ICD) Macro-economic Framework project is to develop institutional capacity in IMF member countries’ ministries of finance, central banks, and other macroeconomic policy institutions to analyze macroeconomic developments and debt dynamics, make consistent projections, assess policy scenarios, and evaluate the impact of macroeconomic risks. The project is agile and incorporates several features, such as, (i) facilitating the combination of economic linkages with the traditional FP emphasis on accounting relationships, thus moving beyond the rule of thumb, partial analysis, and ad-hoc assumptions currently used in financial programming while still allowing expert judgment to play a central role; (ii) giving users a flexible toolbox to support projections and economic analyses; (iii) integrating tools for scenario analyses; (iv) and integrating macro-frameworks with debt dynamics.

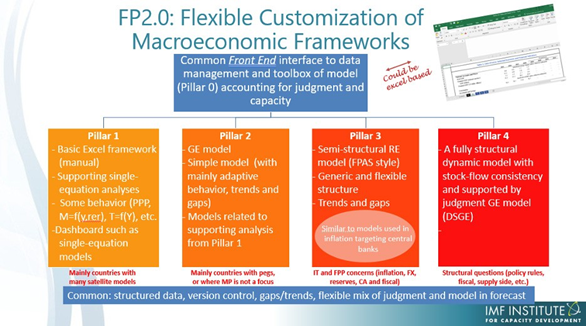

The project is an evolving practice, consisting of four pillars, considering the needs and capacities of countries: (i) an Excel-based spreadsheet version with integrated projection equations, (ii) a simple model with adaptive expectations, (iii) a semi-structural (trend-gap) model, and (iv) a dynamic stochastic general equilibrium (DSGE) model. Each of these approaches and models has its advantages and challenges. Excel-based spreadsheet versions can easily provide detail; semi-structural models strike a middle ground between flexibility and theoretical consistency and can thus help produce data-consistent forecasts and scenario analysis; DSGE models, with its richer economic structure have proven particularly useful for long-term economic policy analysis.

TA projects in the area of macro-frameworks typically start with a scoping mission to take stock of the authorities’ current approach and institutional set-up, to discuss needs, possible solutions, and an indicative timetable. All projects are guided by a results-oriented logical framework that focusses on four areas: (i) building human capacity; (ii) developing, setting-up, and institutionalizing the tools; (iii) integrating the analysis in the policy process; and (iv) enhancing related external communication. High level of commitment and sufficient timeline for the core group of officials to work on macro-frameworks are crucial to ensure the success of TA projects in this area.

As of early 2022, there are close to 40 macro-framework TA projects across all continents. To build capacity, various delivery modalities have been combined – online learning, in-person and virtual interactions, offsite support, and peer-to-peer events. Importantly, IMF has also provided real-time support to update the macroeconomic frameworks, e.g., before important economic policy meetings or rate-setting meetings in central banks. In several countries, the models have been used very successfully to analyze the impact of COVID-19 and analyze different policy responses.

|